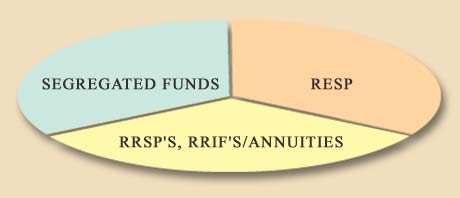

SEGREGATED FUNDS

* view reference charts

WHAT IS A SEGREGATED FUND?Segregated funds are much like mutual funds in that a number of investors deposit money into a fund, the money is pooled and investment decisions are made by professional fund managers. By pooling their money, investors are able to buy a diversified portfolio, reducing the risk to each investor.

So what's the difference between a segregated fund and a mutual fund? Very little in terms of how tile fund cooperates and is managed. However, segregated funds, which are offered only by life insurance companies, generally offer several key advantages.

- Segregated funds are variable deferred annuity contracts.

- No special licenses are required to sell them just a life insurance license.

- Policy owners can designate a beneficiary in favor of a spouse, child, grandchild or parent, so tile proceeds of the policy may be protected from creditors.

- Segregated funds offer a guaranteed death benefit.

- Segregated funds offer a maturity guarantee. After 10 years the company must guarantee to pay the higher of the policy's market value or at least 75% of the premiums (less redemptions) paid into the policy.

Your Goal: Grow your net worth, but limit your risk.

You're saving for retirement. Planning for the future. Working to give you and your family financial peace-of-mind. Naturally, you want to choose an investment with strong growth potential, but the last thing you need is something unexpected shrinking your hard-earned slice of pie. You want protection. And growth (after all, you're not ready to hide your money under the mattress just yet).

One answer may be segregated funds – or

SEG funds,

as they're often called.

Choose from a wide selection of seg funds, every bit as diverse in their risk/reward factors as any mutual fund. But – and here's the big difference – your investments 15%-10% guaranteed (yes, you've read it right – guaranteed). All the best of investment managing combined with protection –that's an impressive combination.

There are other important benefits too.WHO'S BUYING SEG FUNDS?

Millions of people just like you. Maybe you're starting to build a nest egg or planning to retire over the next decade or so.

Perhaps you're nearing retirement and want to secure the gains you've made so far. Whatever your life stage or circumstance, you definitely want market growth with downside protection for the long term.

Of course, you may be a business owner concerned with exposing your savings to business liability and you desire creditor protection. Or you could be a conservative investor who still wants elbowroom for increased earnings.

Any way you look at it, you want growth and protection.

TAXATION

Segregated Funds, like most investments, are subject to taxation. However, unlike traditional investment vehicles like GICs and Canada Savings Bonds (CSBs), which earn only interest income, segregated funds earn dividend income and capital gains or losses in addition to interest income. Dividend income and capital gains are taxed at a lower rate than interest income. This means that segregated funds have a substantial tax advantage over interest-bearing investment vehicles.

RSP TAXATION

Segregated funds registered as an RSP are not subject to tax as tile investment grows. However, when amounts are withdrawn or when an RSP is converted into an income-generating plan such as a RIF, payments is fully taxable as they are received. Financial institutions offering a RIF are required by law to withhold tax on any unscheduled withdrawal.

RIF TAXATION

Tax must be withheld from RIF income that is in excess of the minimum amount in each calendar year. In addition, financial institutions offering a RIF are required by law to withhold tax on an)' unscheduled withdrawal.

Percentage tax withheld on cash withdrawals:

| Cash Withdrawal | All provinces Except Quebec | Quebec Federal | Quebec Provincial |

| Up to $ 5,000 | 10% | 5% | 16% |

| 5,001 to 15,000 | 20% | 10% | 20% |

| 15,000 + | 30% | 15% | 20% |

For RIFs coming from a spousal RSP contribution, any income in excess of the minimum will be taxed back to the taxpayer contributor if the RSP spousal contribution was made in the current, ear or two previous years.

This is in keeping with the rules governing withdrawal of spousal contributions from RSPs. RIF scheduled payments made within the calendar year of purchase will have tax withheld on the full withdrawal amount, as there is no minimum in the year of purchase.

On the death of the RIF annuitant during the deferral period, the balance in the contract is taxable on the annuitant's final income tax return, unless the spouse is the beneficiary and elects to have the proceeds transferred directly into an allowable registered vehicle in his or her name.

RRSP’S,RRIF’S/ANNUITIESDo you think about?

Studies suggest that a properly diversified investment portfolio can help you maximize your returns while minimizing your risk.

Early retirement

Financial security

Your child's education

A dream vacation

A wide range of companies offer many different options and quality financial products suitable for your registered retirement savings contributions. Design YOUR OWN PLAN. By naming a preferred beneficiary, you may be able to protect your RRSR or regular savings plan against creditors and at the same time maximize your return.

Let me know you what's available and help you choose the best option for you!

The cost of education is continually growing each year. At the moment, in order to complete 3 years of university, you must have close to $25,000.00 providing the child living at home.

There are a few options that can help you to start saving for your child's education, so that when the time comes the money is available.

You can start a universal life policy for your child and accumulate a nice return which can be used for educational purposes and at the same time have the insurance paid up.

Also, you can enroll your child in a Registered Education savings plan and get an extra 20% grant tax-free up to $400.00 max each year.

Your child's future is very important and education will play a significant part of it. Don't delay! Start saving today and your child will thank you tomorrow.